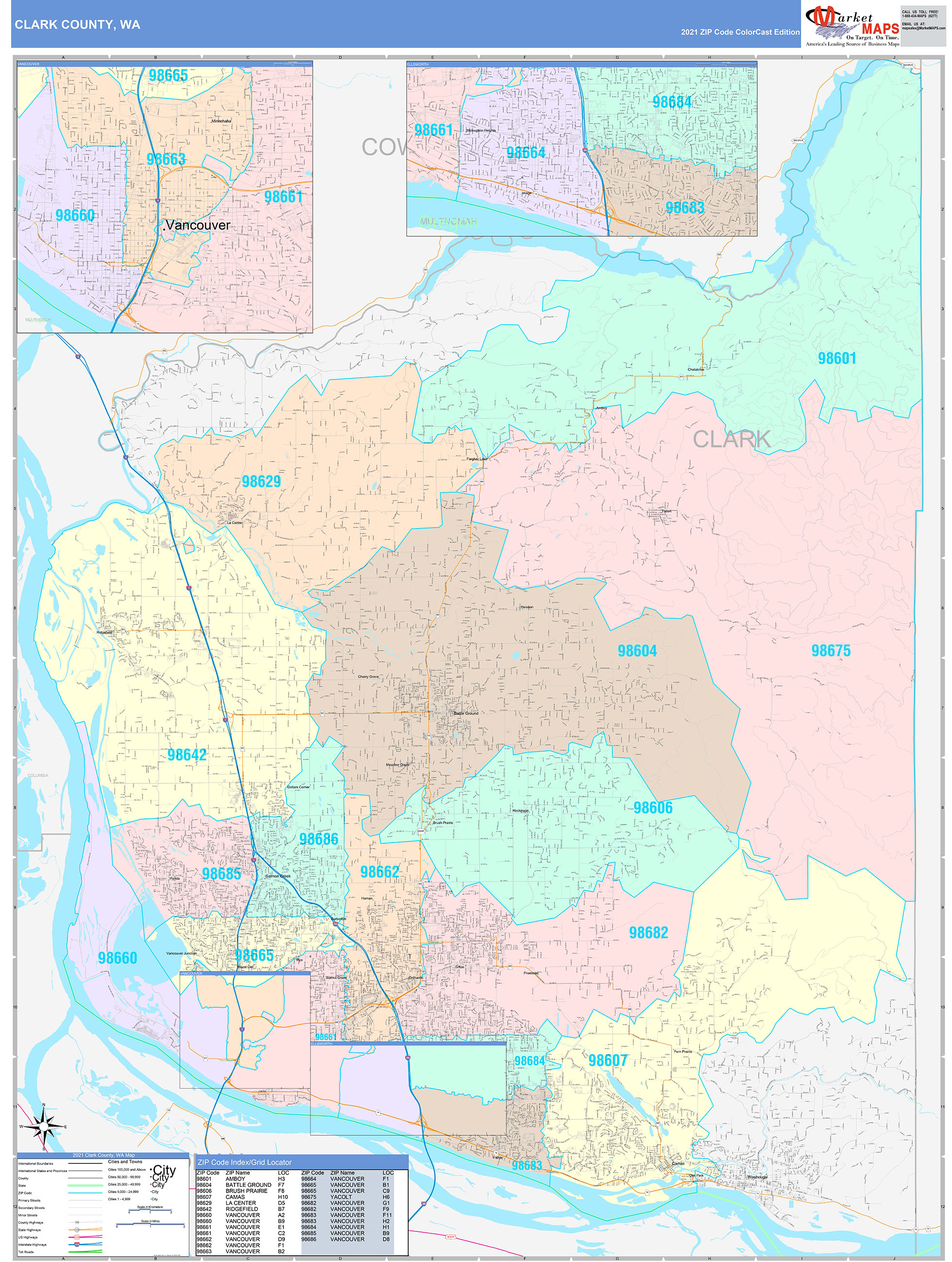

Sales Tax Clark County Wa 30 - Use our local tax rate lookup tool to search for rates at a specific address or area in washington. The current sales tax rate in clark county, wa is 8. 7%. The clark county sales tax rate is 1. 3%. The clark county, washington sales tax is 7. 70%, consisting of 6. 50% washington state sales tax and 1. 20% clark county local sales taxes. the local sales tax consists of a 1. 20% county sales. Click on any county for detailed sales tax rates, or see a full list of. Sign up for our notification. Washington has a 6. 5% sales tax and clark county collects an additional 1. 3%, so the minimum sales tax rate in clark county is 7. 8% (not including any city or special district taxes). For questions about the taxability of your. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. Sales Tax In Clark County Washington Shop | emergencydentistry.com

Use our local tax rate lookup tool to search for rates at a specific address or area in washington. The current sales tax rate in clark county, wa is 8. 7%. The clark county sales tax rate is 1. 3%. The clark county, washington sales tax is 7. 70%, consisting of 6. 50% washington state sales tax and 1. 20% clark county local sales taxes. the local sales tax consists of a 1. 20% county sales. Click on any county for detailed sales tax rates, or see a full list of. Sign up for our notification. Washington has a 6. 5% sales tax and clark county collects an additional 1. 3%, so the minimum sales tax rate in clark county is 7. 8% (not including any city or special district taxes). For questions about the taxability of your. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team.

Click on any county for detailed sales tax rates, or see a full list of. Jul 1, 2025 · lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and annexations. Sign up for our notification. The clark county sales tax rate is 1. 3%. For questions about the taxability of your.

Obits Billings Mt Lexington County Busted Newspaperbex Realty Arizona Super Bowl Commercial Cost 2025

Click on any county for detailed sales tax rates, or see a full list of. The washington sales tax rate is currently 6. 5%. The current sales tax rate in clark county, wa is 8. 7%. Use our local tax rate lookup tool to search for rates at a specific address or area in washington.